Technology-Driven Deflation

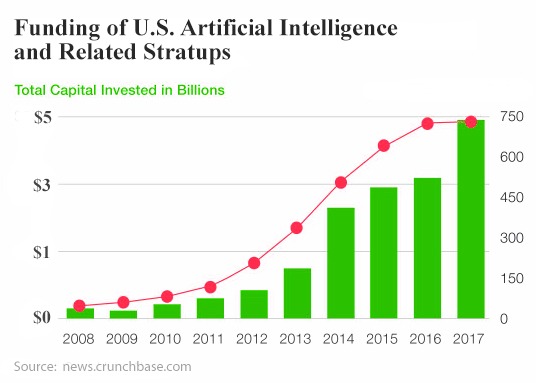

Venture funding for AI is surging as evidenced by the chart below and the trend is showing no signs of letting up; in fact, the trend is so powerful that one can almost start with certainty that technology-driven deflation is going to be a very powerful force to reckon with. Imagine, small companies having the power to do what Amazon does but on a different scale. For example, flippy the burger bot replaces several workers saving a business up to 100K a year

“We are excited about the impact Miso’s AI-based solutions will have for the restaurant industry. Humans will always play a very critical role in the hospitality side of the business… We just don’t know what the new roles will be yet in the industry.”

The Bot will never get tired, never need uniforms and it’s not going to get sick or complain. Bottom line it is the perfect worker for small business burger joints that are looking to contain their costs and improve their services. As for the big players are concerned, it has the potential to reduce their overhead by billions. Last but not least, companies won’t have to worry about paying a minimum wage of up to $15 an hour and providing benefits

Little Caeser’s want to create their own Bot

Pizza chain Little Caesars has been awarded a patent for an AI-based robotic system that will help assemble Pizzas at a significantly faster pace. The patent includes two robots, one stationary arm and another fully-fledged robot chef to handle the dough and take care of oven duties.

According to the company’s explanation in the patent, the robot would free Little Caesars from the tedium of repetitive tasks and allow them to “perform other value-added tasks.” Presumably, that’s the same thinking that gave us Flippy, the burger-flipping robot.

It doesn’t appear to actually cook the pizzas or slice them, and the only listed topping is pepperoni — though it probably wouldn’t be hard to adapt it to other toppings. I’m sure there are only so many ways one can “properly distribute” pineapple or olives. Still, there are other robots already doing the things this particular one can’t — Zume Pizza in Silicon Valley, for example, can shape the dough and bake the pizzas at a rate of 372 an hour.

If Little Caesars were to ever combine their robot with Pizza Hut’s self-driving pizza delivery truck, the only human force we’ll ever need will be a single human to load the pizzas into the car. Full Story

Could the pizza bot move like Flippy? Time will tell

“Now he moves like a ninja and is more reliable,” says David Zito, the CEO of Miso Robotics, which created Flippy.

“We’ve been trained since childhood that robotics were coming in the future,” notes Louise Perrin, an accountant who works nearby. “To be a part of it, to see it and watch it happen live in front of you … is absolutely incredible.”

“I had to come in and see Flippy,” she says. “I’d heard the buzz. The concept of a robot flipping your burger is awesome.”

Central Bankers action could Fuel Technology-Driven Deflation

The shrinkage of the U.S. Federal Reserve’s balance sheet has played a significant role in exerting upward pressure on borrowing costs as parts of the U.S. economy have shown signs of decelerating, a study from the Kansas City Federal Reserve released on Wednesday showed.

The model developed for the study showed the level of reserves plays “an important role in determining the federal funds-IOR spread over the medium- and longer-term and that repo rate dynamics play a relatively less important role,” A. Lee Smith, a Kansas City Fed senior economist and the author of the study, wrote. Full Story

The China Factor

It is premature to say China is coursing toward a Japan-like falling-prices drama. Yet recent data warrant a moderately sized blip on investor radar screens. In November, consumer prices slid 0.3% from a month earlier, while producer prices fell 0.2%. On a year-on-year-basis, producer prices advanced just 2.7% in November, the weakest reading in two years (consumer prices are up 2.2% from a year ago).

Bond traders are taking no chances. Earlier this week, 10-year yields dropped to 3.27%, the lowest in more than 18 months. And, really, they have every reason for gloom considering the headwinds blowing China’s way — and how they may intensify next year. Full Story

Courtesy of Tactical Investor