Live Stock Portfolio Tracker with Analytics

Please scroll down and register for an account. If you use the incognito mode, your portfolios will not be saved.

[stock_portfolio_tracker]

Please scroll down and register for an account. If you use the incognito mode, your portfolios will not be saved.

[stock_portfolio_tracker]

The stock market has been a popular investment avenue for individuals and organizations for many years. Despite its popularity, many experts continue to make predictions about when the stock market is going to crash, and these predictions have often proven to be wrong. In fact, going back to the Tulip bubble in the 1600s, the history of the stock market is filled with examples of experts who claimed to know when the market would crash, yet they were consistently incorrect.

One of the reasons why experts continue to make these incorrect predictions is because the stock market is inherently unpredictable. Market crashes are usually caused by a combination of factors, such as changes in government policies, geopolitical events, economic downturns, and unexpected developments in technology. It is difficult, if not impossible, for anyone to predict when and how these factors will come into play. As a result, predictions about the stock market’s future are often based on speculation and intuition, rather than sound analysis.

Another reason why experts get it wrong is that they often overlook the market’s underlying strength. Despite its volatility, the stock market has proven to be resilient over the long term, and has consistently delivered returns to investors who are willing to hold onto their investments for the long haul. This resilience is due in part to the market’s ability to absorb shocks, recover from downturns, and continue to grow, even during times of economic turbulence.

From a bullish perspective, a stock market crash can be seen as a buying opportunity. During a market crash, prices of stocks often fall dramatically, and investors who are willing to take advantage of the dip can buy high-quality stocks at a lower price. Over time, as the market recovers, these stocks are likely to appreciate in value, delivering substantial returns to the investor.

On the other hand, a contrarian perspective would argue that a stock market crash is a sign of systemic problems in the economy. During a market crash, investors are usually panicked, and they tend to sell their stocks, causing prices to fall even further. This creates a vicious cycle, as investors become increasingly pessimistic and sell even more of their stocks, causing prices to fall even more. A contrarian would argue that a market crash is not a buying opportunity, but rather a sign that it’s time to get out of the market and wait for better times.

In conclusion, while experts continue to make predictions about when the stock market will crash, their track record has been consistently poor. The stock market is inherently unpredictable, and its resilience over the long term suggests that it’s often wise to ignore the noise and focus on building a diversified portfolio that is well-positioned to withstand short-term turbulence. Whether a market crash is seen as a buying opportunity or a warning sign will depend on the perspective of the investor, but it is important to understand that, over the long term, the stock market has proven to be a reliable investment vehicle for those who are willing to be patient and stick to their investment plan.

Pray tell, in these times of economic turmoil and financial insecurity, it seems as though the masses are quick to bemoan the stock market and its tumultuous ways. Yet, it is often the case that such bearishness proves to be unwarranted, for as the great sage Warren Buffett has oft stated, the markets are a veritable guarantee to rise in the long term.

And so, even as the spectre of market crashes looms large, the astute investor must not be swayed by the rabble’s fearmongering. Nay, rather one should view these tempests as opportunities to buy quality stocks at a discounted price. For, when the masses are in a state of panic and selling off, the wise investor takes advantage, backed by the knowledge that the central bankers of the world shall not let the markets falter for long.

Indeed, look around and observe the various stimulus programs being announced. Money shall continue to flood the markets, and the fear of the masses shall be assuaged. So, embrace the corrections, good sir or madam, for they shall bring bountiful opportunities for those who have the foresight to see it.

Ah, but let us not forget, amidst all the uncertainty and turmoil, that a market crash can be a rare and wondrous opportunity for those with the mettle to seize it! For when the masses panic and sell off their stock in a frenzied haste, the astute investor sees not Chaos and despair, but a veritable feast of bargains and opportunities waiting to be claimed!

Indeed, as the smoke clears and the dust settles, the shrewd investor calmly approaches the market, seeking out the gems that have been cast aside by the masses in their blind panic. And as they fill their portfolios with these undervalued treasures, they bask in the knowledge that they have outmanoeuvred their less insightful counterparts and emerged from the crash not merely unscathed, but richer for the experience.

So, let the market crash if it must! For those with a contrarian spirit and an unwavering faith in their own instincts, it is but a minor bump in the road, an obstacle to be overcome on the path to riches and success!

Stock Market Watch is our most popular and oldest stock market update service. As numerous upgrades and 2 upgrades are sent out through email.

1) Each couple of two comprehensive updates are shipped out; one around the centre of this month and the next near the end of the month. In between, as many upgrades necessary are routed out.

2) Every problem includes the industry comment segment. Within this part, the management, the tendency and the arrangement of this market are analyzed.

3) At least 5-10 brand new plays are issued in every upgrade………. The performers fall under these categories. To learn more, click on some of the classes below.

4) Our proprietary indices are updated each time deemed necessary. For information on these proprietary, see please here. Bonus for Joining now additionally, we provide an amazing bonus known as the safety centre. We give you the ability. Imagine being able to browse the internet. Don’t be duped. The majority of the services leak facets of your IP address out. This is called IP flow and high-cost charges. The support we’ll advocate is anonymous, with no IP escape.

About what’s given in the security centre for details, please click here. In our view, this is priceless as you’re supplies you with ways to completely reclaim your privacy and maintain it like that. The best of 95% of these tips will cost you, and the remaining 5 percent along with nothing endure a very moderate price. For complete details on the service, click on Stock Market Watch: Tactical Investor Past Calls

Fintech is a mix of the words”fund” and”engineering,” and it is a broad category that includes businesses that employ new technologies to financial companies. Businesses that develop electronic solutions could be regarded as run and as might build payment software.

The possibility of fintech is really exciting. Even following the payments area in the last couple of years increase, the vast majority of payment arrangements around the globe are done in money. And though banking associations that online provide fee arrangements and interest rates which are far greater than those of banks, nearly all consumers utilize banking due to their needs.

As stated, fintech is a wide term that describes some firm that applies technology into the area of finance. There are various kinds of businesses which fall beneath the umbrella that is fintech. Merely to name a couple: Payment processing Online and mobile banking peer-to-peer and Online (P2P) creditors Person-to-person obligations Financial applications Fiscal services over the last several decades, Square (NYSE: SQ) has evolved out of a means for retailers to accept credit cards with their cell phone to a large scale small-business and respective financial ecosystem.

Possibly Square’s most fascinating portion is its own Money App, with 24 million active users going to infinite capability and 2020 to build its own service offerings out.

Most of us know we shouldn’t mix our minds with a bull stock market, but that’s exactly what we risk doing if we concentrate on operation over five or fewer years. Given that this bull market is about to enter its sixth season, it’s a fantastic bet that a number of the best consultants in the preliminary performance positions only look like geniuses. 1 way to mostly eliminate the use of fortune is to focus on a whole market cycle — one that includes a bear market. Performance advisers have been focusing on functionality for years because they encircle both the current bull market but also the worst bear market since the Great Depression.

Their annualized returns range from 9.7% to 16.7%, versus 6% to the dividend-adjusted S&P 500 index. Note that because the majority of the performers over this period try to maintain their version portfolios nearly fully invested in any way time, they can be expected to suffer big losses during a bear market. However, if the future resembles the past, come out ahead of those who take part in market time — and they can create more during other occasions to more than make up for these losses.

Huge amounts of money have abandoned the marketplace, suggesting the audience is panicking at the incorrect time. History illustrates the Crowd is not right over the long term; they undergo moments of success but these minutes dwarf years of declines when the markets take off, they’re made to survive.

The Dow Jones market has now dipped under 27K (on monthly basis), and so There’s a fantastic chance that one of the 2 results we prefer can come to pass:

The Dow falls fast and hard into the 25,500 into 26,000 ranges, the audience stampedes and in doing so produce a beautiful long-term chance for Tactical Investor. The industry pull-back a little and after those tendencies sideways and in doing this pushes our signs to the oversold ranges.

That’s the reason the rewards are very significant and that’s the reason there’s not any reward, but it requires effort to stay calm in the face of fear although it requires no effort. Mass Psychology shows you shouldn’t follow the herd since they do the incorrect thing at the ideal time.

Before we get in the perspective lets look at what we have stated over the last few months:

The strategy under these circumstances is to make use of pullbacks to start places in businesses; the more powerful the pullback, the greater the chance. We can see indications which 2018 ought to be a fantastic season for those markets. Individuals awaiting the entry points will likely be left.

They wish they’d purchased, as they did back in 2009, 2015, 2018 and currently in 2020 and will return at the entrance points. If push comes to shove, they bend and drop for the exact same play, although the audience never learns they state that they need to try out something fresh.

It requires a particular sort of dumb to be a Permabear; the one that a million hard slaps won’t change.

Permabears have a death wish; for nothing else could describe this means of thinking, they’re begging to be taken to the cleaners. A simple evaluation of any term graph will establish that being a Permabear is not likely to pay off. There’s not a single long term graph that may prove that carrying a position, in the long term, has paid off.

Copper continues to devote a pattern and we all guess it won’t be long then until the markets burst, after the MACD’s on the graphs encounter a crossover.

In the event the market pulls back, it is a bonus, and that is precisely why we also adopt the position that if the trend is upward; the more powerful the stalks, the greater the chance. Because the tendency is upward pullbacks should be looked at as Christmas bonuses. Pullbacks may be used to start or add to the present rankings of one.

An individual can observe that from crashes, corrections that are powerful or a long-term perspective, are not anything but purchasing opportunities. Buy when there is blood flowing on the roads once the herd turns off and run to your life.

As stated by the alternative Dow Theory, when the Dow utility commerce to fresh highs, it suggests the general market will follow suit sooner than after.

At this point, anyone may probably get their Dow Jones predictions wrong, as the international economic aftermath of the coronavirus can’t be anticipated while the crisis persists.

On the flip side, an analysis of the index’s components and its own historical behaviour during and after certain disasters could stage investors in the right direction when it comes to drafting a potential Dow Jones index forecast for 2020.

So far, the major stock indices across the world have lost a significant portion of their value, with the DJIA falling by nearly 30 percent, followed with the S&P 500 that has lost nearly 28 per cent and the FTSE 100 whose worth has dropped by 26 per cent since February 20, when the markets starting falling off a cliff without any signs of recovery on the horizon.

However, no academic could predict a worldwide pandemic like the coronavirus outbreak because the ultimate cause for a worldwide recession, and to be honest, that would?

-Or worse, will the Dow Jones go up anywhere near its pre-coronavirus degree in the not too distant future?

Many economists have been warning that a possible recession was right at the corner, pointing out to many variables and deploying notions. These included a possible passive-investment bubble, the deceleration of the global market because of a supply-demand imbalance, and possibly damaging aftermath of this continuing (yet paused) US-China trade warfare.

Dow Jones forecast for July 2020.

The forecast for the beginning of July 25735. Maximum value 26639, while minimum 23270. The averaged index value for month 25100. Index at the end 24755, change for July -3.8%.

DJIA forecast for August 2020.

The forecast for the beginning of August 24755. Maximum value 25241, while minimum 22383. The averaged index value for month 24048. Index at the end 23812, change for August -3.8%.

Dow Jones forecast for September 2020.

The forecast for the beginning of September 23812. Maximum value 25498, while minimum 22612. The averaged index value for month 23994. Index at the end 24055, change for September 1.0%. Read more

This Dow Jones forecast for 2020 and 2021 relies on our 2 major indicators: Treasury prices as well as the Russell 2000. The first one states that’danger on’ is currently returning to markets, another one was’risk-on’ is starting as soon as the Russell 2000 index crosses 1625 points.

Based on the components within this guide we conclude that the likelihood of stock markets moving greater in 2020 and 2021 is large. Our Dow Jones forecast is bullish for 2020 and 2021. This implies that we can reasonably anticipate returns in stock markets.

We strongly recommend readers to subscribe to our free newsletter as we will be publishing those high potential multi-baggers we identify in 2020.

Our prediction to the Dow Jones is bullish for 2020 and 2021! We predict a peak to 32,000 points at the Dow Jones in 2020 and the index will rise further in 2021.

What we are interested in is to understand whether the stock bull market is the place to be spent in for 2020 and 2021. We want to be invested in bull market trends, and this will be helped with by the Dow Jones forecast.

As said before we’re watching out of markets that eventually become a multi-bagger in 6 to 9 months time. We dedicated earlier Forecasting The 3 Top Opportunities Per Year Becomes InvestingHaven’s Mission. We can know in which way to look for all these returns that are extraordinary if we get the level tendency.

Dow Jones predictions: The Dow appears to have broken through the top of the Channel formation that fell in the 20,800-21,000 ranges. If it closes above 21,300 on a monthly basis then despite the markets being overbought, the Dow could surge past 22K before running into a strong zone of resistance. Market Update June 18, 2017

Give the resiliency of this market; the Dow could very easily trade to 22K before it trades to 19K. The masses need to show some enthusiasm; if they don’t and the market pulls back strongly, then it has to be viewed as a screaming buy. For now, the masses seem to be locked in the pessimistic mode.

The bullish sentiment has never traded to the 60% ranges even once this year; it did not even make it to the 55% ranges, and that is very telling. On the same token, the number of individuals in the neutral camp has generally continued to trend higher and higher. Market Update July 6, 2017

Not only did the Dow Jones trade to 22K but it surpassed this target and is now dangerously close to striking 23K. The sentiment is still not bullish, so the path of least resistance is upward. As for Dow 30K; there is a good chance that the Dow could strike this target. We discuss that in full detail in this article titled “Dow Could Trade to 30K But not before This Happens ”

If you prefer to watch a video; then the video covers the essential points of the above article

Dow Jones forecast for January 2020.

The forecast for beginning of January 28538. Maximum value 29368, while minimum 26044. Averaged index value for month 27914. Index at the end 27706, change for January -2.9%.

DJIA forecast for February 2020.

The forecast for beginning of February 27706. Maximum value 28512, while minimum 25284. Averaged index value for month 27100. Index at the end 26898, change for February -2.9%.

Dow Jones forecast for March 2020.

The forecast for beginning of March 26898. Maximum value 29007, while minimum 25723. Averaged index value for month 27248. Index at the end 27365, change for March 1.7%. Read More

Our Dow Jones forecast for 2020 and 2021 is strongly bullish. We expect the Dow Jones to peak near 32,000 points in 2020. It will continue its rise in 2021. We forecast a crash in the Dow Jones in 2022. Investors should get the maximum out of the bullish potential from our Dow Jones forecast for 2020 and 2021. Note that this another critical piece in our annual series of forecasts because it paints a very clear picture of our general market forecasts for 2020: bullish stock market (not only this bullish Dow Jones forecast but all global stock markets), bullish peak in precious metals, some commodities bullish, strongly bullish crypto markets.

Why This Dow Jones Prediction?

What we are really interested in is to understand whether the stock bull market is the place to be invested in for 2020 and 2021. We want to be invested in bull market trends, and the Dow Jones prediction will help with this.

As said before we are on the lookout of markets that become a multi bagger in 6 to 9 months time. We committed before on this: Forecasting The 3 Top Opportunities Per Year Becomes Invsting Haven’s Mission. If we get the high level trend right we can know in which direction to look for these extraordinary returns. Read More

The data below serves as further proof that the economic recovery is nothing but an illusion. It has only benefited those who don’t really need it. The rich have become even richer, the middle class has vanished and the poor are becoming even poorer.

Sentiment indicates the masses are not bullish so this market is not ready to crash. Instead of panicking make a list of stocks you would like to own and when the market’s pullback, buy these quality stocks at a huge discount.

One jackass (oops we mean expert) after another, has been predicting that a Stock Market Crash is coming. The problem is that these brain surgeons have been making this argument for so long it almost sounds like the definition of insanity. Insanity boils down to doing the same thing over and over again and hoping for a new outcome. These predictions are so off the mark that they make a broken clock look fantastic which happens to be right once or twice a day depending on whether you follow military time or not.

This claim is based on the fact that Buffett is sitting on $86 billion in cash. They use this information to create the illusion that this Buffett Indicator 2019 is predicting a stock market crash.

To us, this seems like the ramblings of an insane individual. Just because Warren Buffett is sitting on billions of cash does not mean he is waiting for the market to crash. He is probably waiting for a good deal; that’s all.

Some might point out that it’s the biggest hoard of cash the company has ever built up and that this indicates that Buffett is nervous. Being nervous does not equate to betting on a stock market crash. Buffett is a valuable player and he is looking for a deal, so correction not crash might be all he is waiting for.

Buffett Does not believe stocks are overpriced; hence he is not expecting a stock market crash

While Buffett agrees the market can go through a period of turbulence, he stated that “no one can tell you when these traumas occur.”

“American business—and consequently a basket of stocks—is virtually certain to be worth far more in the years ahead. Innovation, productivity gains, entrepreneurial spirit and an abundance of capital will see to that,” Buffett said.

Bottom Line Buffett would view these pullbacks that could range from mild to extreme as buying opportunities and so do we.

In a recent article, Buffett stated that stocks were on the cheap side; one does not make a comment like this if one believes the stock market is going to crash

This market is unlike any other market; it has moved from being the most hated bull market to the most insane bull market (fanaticism stock market crash) of all time. In such an environment technical analysis is technically trash and fundamentals are fundamentally flawed. In fact, for the most part, market technicians have no idea of what they are talking about; they figure that by studying someone else theory or drawing squiggly lines on some chart they can decipher the market.

We have dealt with at least 15 so-called expert technicians who claimed to have found the Holy Grail; in the end, their theory was full of holes and could not account for sudden and rapid trend changes. Technical’s do not drive the markets, and neither do fundamentals; emotions drive the market. Understand the emotion, and you can identify the trend. Identify the trend, and you can determine the primary direction of the market. If the trend is up, then you don’t need to worry about crashes or correction; the market will not crash when the primary trend is up. It will, however, experience corrections, all of which will prove to be buying opportunities until the trend changes.

Simple, prudent money management skills will protect your profits and reduce your losses. Fundamental analysis is even worse; at least technical analysis can be useful when combined with sentiment analysis. Fundamentals boil down to pouring over standard data, and you are usually looking at what happened and not what will happen. We will not spend more time on that topic as in our opinion fundamental analysis is in today’s markets is a total waste of time.

What many experts fail to understand is that a bull market starts only after the old high has been taken out. Until that occurs, it’s not a real bull market. In that sense, the NASDAQ bull has just started. For over 15 years the NASDAQ struggled to overcome this hurdle. Jack in the box is what comes to mind; so like a coiled spring, it is ready to trade a lot higher before it breaks down. The NASDAQ has already broken past the psychologically (contrarian investing) significant 6000 level, so the odds are fair to high that it should roughly double from its breakout point; a move to the 9000-10,000 ranges might appear insane now. Experts would have felt the same way if someone told them that the Dow would be trading past 21K after it dropped below 7,000 in 2009.

Don’t expect the upward journey to be smooth; the higher the Nasdaq trades, the more volatile the ride will be. In the interim, it would not surprise us if the Nasdaq eventually dropped down to the 5200-5400 ranges with a possible overshoot to 5,0000 before testing 6700.

Sentiment continues to paint a fascinating picture as it indicates that for the 1st time in decades the crowd is not driven by panic or euphoria.They are uncertain, and uncertainty is the 1st stage of fear, indicating that the markets are a very long way off from hitting the Euphoric zone.

Overall, looking at the situation from a mass psychology perspective what we stated in 2014, 2015 and 2016, continues to hold; this bull market could end up running a lot higher than the most ardent of bulls could ever envision. It has already caught some of the most ardent of bulls by surprise; some of them even turned negative this January.

Furthermore, according to CNN most Americans are not investing in the stock market

“I have a little bit in my checking [account], a little bit in my savings,” Coomer, a grandma of three who still works 55 hours a week at the gas station, told CNNMoney. Coomer is part of over half of America that has $0 invested in the stock market, as research reports and surveys have found. One survey from Bankrate found that 54% of Americans have no money in the stock market.

That means no money in pension funds, 401(k) retirement plans, IRAs, mutual funds or ETFs. “For the majority of the people here, the stock market is something interesting to look at,” says Chuck Caudill, general manager of the local newspaper, The Beattyville Enterprise.

Therefore until the masses embrace the market, this bull will trend a lot higher as the only way the top players can bank their paper profits is to unload these shares onto the unsuspecting masses. Many would point out that the masses are broke. Banks and various lending clubs are already offering unsecured personal loans ranging from $2,000 all the way to $100,000. However, we expect the rates to drop even further but more importantly supportive documentation requirements will be dropped to a bare minimum. We will move back to the era of Liar Loans

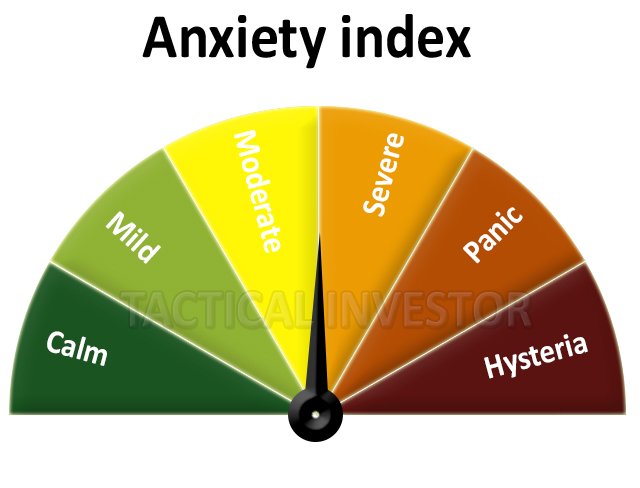

A back breaking correction needs at least two elements; the masses should be euphoric, and the market needs to be trading in the extremely overbought ranges. At the moment, the market satisfies only one of these conditions. A small wave of selling will propel the masses into the hysteria zone, which will create a mouth-watering opportunity. Markets don’t crash when the masses are in disarray; they crash when the crowd is jumping up with Joy. The experts will probably confuse the next correction for a crash, but what can one expect from individuals who have been on the wrong side of this Bull market since its inception.

This Video Illustrates How the Crowd is manipulated: Fear Mongers love to sell Stock Market Crash and other Doomsday scenarios. Misery Loves Company so don’t fall for the nonsense that the Buffett indicator is predicting a stock market Crash mumbo jumbo prediction. Instead, try to view stock market crashes as buying opportunities for until Fiat is eliminated the markets will always trend upwards.

Published courtesy of the Tactical Investor

For the past few years much the angst of many experts we have consistently stated that the markets were not ready to crash. Moreover, we believe that Experts are not Smart Enough to Spot Stock Market Crash 2017. If they were they would not have made the same predictions in 2014, 2015 and 2016. All these predictions of disasters proved to be nothing but idle chatter.

From late 2016 to early 2017, many former Bulls who predicted the direction of this market quite well, suddenly decided that the stock market was ready to crash. We, however, begged to differ, and we provided two very simple reasons for our stance.

The masses have remained nervous throughout this bull run; no bull market has ever ended when the masses are nervous. History indicates that stock market crashes begin on a euphoric note and end on a note of hysteria.

We focus more on the psychology of the masses than on any other single factor. However, the 2nd most important factor is the trend. The trend has remained positive throughout this bull run; occasionally it has moved into the neutral zone, but it has never turned negative. We are not talking about the trend based on the drawing of simple trend lines but one that is calculated utilizing several factors one of which happens to price action.

So when the experts started to scream over and over again about the impending stock market crash of 2017; these are some of the comments we recently made to our readers and or subscribers

Let the experts sing their songs of doom and con the masses; it takes two to tango, one to cry and three to have a party. We have experts from the technical analysis side and experts employing fundamentals trying to use to back their faulty assertions. Unfortunately for these penguins both of them are wrong. They have failed to pay attention to the psychological factor. There is no factor more important when it comes to playing the markets then market psychology. Market Update April 30, 2017

The market marches to its beat and those that resist are drained; financially speaking that is. We are not fortune tellers; we reserve that noteworthy task for the experts who seem to take delight on spewing rubbish week after week. The media then regurgitates this rubbish, and a jackass is suddenly made to look like a movie star. What a wonderful world we live in and people wonder why they lose money after listening to these wise men.

We, on the other hand, prefer to listen to what the market is saying and that is why we never listen to our gut instinct or let our emotions into the equation. We look for trends. Market Update May 19, 2017

The emotional state of the masses; the herd, for the most part, has been oscillating back and forth from the neutral to the Bearish camps; very few have dared to venture into the bullish camp. This probably explains why the bullish readings never even came close to testing the 60% ranges for the past 15 weeks and counting. During that time the market has been trending higher and higher. This has caught many an expert with his pants down. But there is no surprise here; the reason as we have stated so many times over and over again is that the Crowd is not euphoric and the trend is still bullish.

The same pattern holds true for most of 2015 and 2016; the number individuals in the Bearish and neutral camps outnumbered those in the bullish camp. If you are in the Neutral camp one of two things one of two things apply; you are either are a bear that got burned or Bull with no courage to take a position.

Our proprietary sentiment indicator also confirms that the masses are still antsy.

If the markets were extremely overbought, then it should be almost impossible to find stocks that are trading in the oversold ranges on the monthly charts. On a monthly chart, each bar represents one month’s worth of data on; these charts provide great clues of what to expect from the markets.

In the Dow, we spotted several stocks that were trading in the extremely oversold ranges to oversold ranges on the monthly charts. AAPL, HD, DIS and NKE are examples of such stocks.

We also examined roughly 150 random Midcap to large cap stocks (ETF’s were included in this analysis) from various sectors; we found that almost 60% of the stocks examined were trading in the oversold ranges; one ETF that caught our eye was IBB; it is trading in the extremely oversold ranges.

We also noted that the net number of new 52 week highs continuously exceeded the net number of new 52 week lows. Why is this important? It indicates that the internal structure of the market is healthy.

Our stance for the past 11 years has been that the Dow Theory is dead; we provided an alternative Dow Theory that has proven to be far more accurate than the original. This theory states that it is the utilities that should be followed and not the transports. We will cover this in more detail in a follow-up article next week. In essence, it is the Utilities that lead the way and not the transports.

The utilities started to consolidate roughly from Aug of 2016 and bottomed out in Nov 2016 and had consolidated for roughly three months before they started to trend upwards. The utilities are now surging to new highs, and this bodes well for the overall market. The alternative theory states that the Dow should follow suit.

This is a mature bull market so one should not expect it to trend in one direction only; it will experience several corrections ranging from mild to severe. Unfortunately, the Dr’s of doom will confuse this correction for a crash as they have mistakenly done so for the past eight years and counting. When the masses embrace this market, the end will be close at hand; until then strong corrections should be embraced.

There is a lag period between the utilities and the Dow; sometimes it comes down to just a few weeks, but usually, it ranges from 3-5 months. The Dow has been consolidating since March; it has essentially been trading in a tight range. Even though the Dow did not pull back strongly, the sideways action helped it blow out a large dose of steam as envisioned by the MACD’s and several other technical indicators that are trading in the oversold ranges. The lag period was roughly three months as the utility bottomed out in Nov and the Dow started to consolidate in March of 2017.

The stock market crash theme makes for great headlines as fear sells well, but that is all it has been good for so far. The market will experience a much stronger correction over the course of the next 6-15 months, but until the masses embrace this bull market, those corrections will prove to be buying opportunities.

The overall Market sentiment illustrates that the masses are not jumping with joy. The trend is positive, and the Dow Utilities have surged to new highs. Therefore under such conditions, it is hard to envision a crash like a scenario.

Every bull market experiences one back breaking correction that is mistakenly labelled as the beginning of a new bear market. When that occurs, it will be a sign that the end is close at hand. That strong correction will subsequently trigger an even stronger rally and fuel a feeding frenzy. Sentiment will turn bullish, and the masses will dance with Joy, then the bottom will drop. However, we are not at this stage, so there is no point in further developing this story line.

Our ideal setup would call for the Dow to shed 600-1000 points over a very short period; this would drive the masses into the hysteria zone. A small push is all it would take to drive the fear factor through the roof. We all know what happens next; the masses stampede, the smart money swoops in, and history repeats itself once again. For the masses, it is groundhogs day every single day.

A genius can’t be forced; nor can you make an ape an alderman.

Thomas Somerville

Published courtesy of the Tactical Investor

The stock market crash story is getting boring and annoying to a large degree. Since 2009, there has been a constant drumbeat of the market is going to crash stories. In 2009, many experts felt that the market had rallied too strongly and that it needed to pull back strongly before moving higher up. They were calling for 15%-20% correction.

Ten years later and most of them are still waiting for this so-called strong correction or crash. A stock market crash is a possibility but the possibility is not the same thing as certainty, and this is what seems to elude most of the naysayers. One day they will get it right as even a broken clock is correct twice a day. In the interim waiting for this stock market crash has cost these experts a fortune, both in lost capital gains and actual booked losses if they shorted this market.

It’s 2017, and the markets are overbought, and we agree that they need to let out some steam, but as for a crash that will only occur when sentiment turns bullish. The crowd has not embraced this market and until they do corrections but not crashes is what we should expect. In fact, we penned an article titled “Dow Could Trade to 30K But not before This Happens”, where we discussed the possibility of the Dow trading to 30k before it crashes. The one factor that could alter this outlook would be for the masses to turn bullish suddenly.

This market will experience a spectacular crash one day; nothing can trend upwards forever and eventually the market has to revert to the mean. Markets never crash on a sour note; the crowd is chanting in joy when the markets suddenly change direction. A simple look at previous bubbles will prove this; the housing bubble, for example, did not end on a note of fear; the crowd was ecstatic. Even the Tulip bubble that lasted from 1634-1637 ended on a note of extreme joy.

Jim Rogers states that the next crash will be the worst one we have seen in our lifetimes.

We’ve had financial problems in America — let’s use America — every four to seven years, since the beginning of the republic. Well, it’s been over eight since the last one. This is the longest or second-longest in recorded history, so it’s coming. And the next time it comes — you know, in 2008, we had a problem because of debt. Henry, the debt now, that debt is nothing compared to what’s happening now.

In 2008, the Chinese had a lot of money saved for a rainy day. It started raining. They started spending the money. Now even the Chinese have debt, and the debt is much higher. The federal reserves, the central bank in America, the balance sheet is up over five times since 2008. It’s going to be the worst in your lifetime — my lifetime too. Be worried Business Insider

In a broad manner of speaking, he is right, but the proverbial question as always is “when”; so far the naysayers have missed the mark by 1000 miles. This entire rally has been based on the fact that the Fed artificially propped the markets by keeping rates low for an insanely long period and infusing billions of dollars into the markets. One day the pied piper is going to collect but as we have stated over and over again over the years, that until the masses embrace this market, a crash is unlikely. A strong correction is, however, a certainty; it’s just a matter of time.

The market has defied every call, and even some of the most ardent of bulls are now nervous; we stated this would occur over two years ago. The Market has put in over 36 new highs this year and is living up to the new name we gave it late in 2016. Up to that point, we referred to this market as the most hated bull market of all time; after that, we started to refer to this market as the most Insane Stock Market Bull of all time. Insanity by definition has no pattern so expect this market to do things no other market has ever done before.

We are using the word correction and not crash for until we start seeing non-stop headlines for Dow 35K, and the overall sentiment turns bullish, the markets are unlikely to crash. Sentiment analysis reveals that the crowd is still either uncertain or bearish when it comes to the stock market.

The article of interest: What every investor should know about the Dow theory?

From a technical basis, the markets are extremely overbought. However, markets can remain irrational for a lot longer than most players can remain solvent. An overbought market does not mean that the market is ready to crash. Take a look at the stock NVDA; the stock has been trading in the overbought ranges for over two years, and instead of crashing, it has continued to trend higher.

The market will crash one day, and it will probably be quite a spectacular crash as this market has soared to stunning heights. The main driving force behind this massive move has been and still is hot money. However, we have continuously stated that this bull market would not crash until the masses embraced it. In 2016 we informed our subscribers that the Dow was getting ready to trade to 21K; this target was hit within three months. The Dow went on to trade to 22K and sentiment is far from bullish. History indicates that markets always crash on a note of euphoria. Instead of worrying about a future crash, why not put in a few common sense measures that could reduce your risk but also allow you to profit from this bull market

On a separate note, Gold is holding up fairly well, and as long as it does not trade below 1250 on a weekly basis, it has a good chance of testing the 1360-1380 ranges with a possible overshoot to 1400.

Don’t fixate on the crash factor; instead look for great stocks you would like to own. When the market eventually corrects, you will be in a position to pick up top players at a great price.

Yes it is but so is death; nobody sits around worrying about that event every single day, do they?

Posted courtesy of the Tactical Investor

A new trend can begin that is based on fake news or false data to create the illusion all is well. Remember that the truth or lies are just a matter of perception. One person will swear that he is telling the truth, while another will swear that he is lying. From an observer’s perspective, both are correct.

They are convinced of their position, so all you will do is waste your time and energy trying to sway them. Instead, you are better of letting them battle it out, while you sit down and take a look at the real events that are unfolding, most of which the masses are oblivious too. The main principle of trend investing is not to focus on the noise factor but to pay attention to the “reality factor”. In other words, trend investing focuses on what is going on minus the morality or judgemental angle.

Personal views are on par with toilet paper regarding their relevance in determining trends. Oh, by the way, we also include ourselves into the equation. This is why we do not voice our personal opinions as nothing will change, and if we let our personal opinions cloud our judgement, then the ability to look at the situation objectively is lost.

Over time it gets easier and easier to do this, and then one day you wake up, and it is almost like breathing. Practice makes perfect, and there is no better time to start than today for tomorrow never comes. Today is the tomorrow you dreamed of starting something new yesterday but never did and most likely never will. If you want to spot new trends you can’t allow your emotions to do the talking; once you emotions talk, logic goes out the window and stupidity

In order to spot new trends one should not allow one’s emotions to do the talking; once your emotions take over, your logic goes out the window and stupidity is in charge of the situation. This is the first principle you need to muster before you can develop the ability to spot new trends.

Whether you and I agree with it or whether it is morally right or wrong is irrelevant. Nothing can stop a trend in motion. This bull market is a perfect example of fake news driving a new trend; all the data imaginable has been manipulated to create the illusion that the economy is doing well. If we had allowed our personal opinions to dictate the way we trade, then like all the fools out there we would have missed the biggest bull run of all time.

Trend investing provides you with the opportunity to see the real picture as opposed to the one the mass media forces you to focus on. The idea is to sell when the masses are dancing and buy when they are nervous.

Trend investing states that the trend is your friend, everything else is your foe. Mass Psychology clearly states that the crowds always oppose the trend and as a result, they are always on the losing end of a trade.

Posted courtesy of the Tactical Investor