Stock Market Outlook: As stated in the stock market update, its buddies would do anything it took to make the belief that shorting the market is a recipe for failure. The idea, as we mentioned, is and was, to induce every Tom, Dick and Harry to adopt this bull. One just has to consider Monday’s actions to determine just how much they are willing to move thus, whatever crap they pump out from the information, that pullback will solve itself since the Fed and its allies will come out to drive money to the markets or directly intervene by encouraging the system.

As detailed at FAQs that are upgraded and also a term sheet, the SMCCF will buy bonds to make a bond portfolio that’s based on a broad market indicator of US bonds. This indicator consists of the bonds in the market which were issued by US firms that satisfy other standards of adulthood, along with the facility score. This indexing strategy will match the current buys of funds for the facility.

The Markets were yanking on Monday, and the Fed comes out and leaves viola and that statement. They aren’t even allowing the Dow to examine the 23K ranges. In the long run, these bears will wind up turning to bulls, and that is going to mark the conclusion of the cycle, which is accompanied with a crash, which may indicate the baby bull’s arrival. US Stock-index stocks were higher Tuesday afternoon, aiming to add to the rally of the day that President Donald Trump has been currently financing a $1 trillion infrastructure spending bundle to include more stimulus to help the economy recover from the pandemic.

We said that an infrastructure bundle would be published since the COVID pandemic has granted the ability to the Fed and the authorities. Watch the creativity here. Produce an issue and offer whilst creating the pay to offer a solution. Look they’ll create more if needed and how many trillions of dollars they’ve created over the last 7 weeks. Notice something else; lots of Folks are shedding their tasks or will. As we mentioned the most expensive element in any company is the element that is human. If you’re able to eliminate high paying jobs and continue to boost efficacy with

machines.

The effect is deflationary regardless of the inflation by generating bucks generated. The Future Of Function: It begins with distant working. They’re pushing an increasing number of individuals to work at home. What happens next? Then why would they be in the USA In the event employees working at home do too the task? See another point: they will begin talking about outsourcing those tasks or notify Americans that they must work for work or less out of a different nation for less. And this will happen on a worldwide basis. All in all, the benefactor from this activity will be parts of South America, parts of Eastern Europe and Asia.

We will expand this further. Therefore, while America will continue to flourish employees irrespective of the ranking they hold and will probably be a place, won’t fire well. At the

In the era of AI, also the self-employed which have and the businessman. There are exceptions, and yet another approach is to be certain to stay ahead of the learning curve; Quite simply, you are great at your work. The alternative when you’ve got a job that is fantastic would be to learn more about the idea of becoming an independent contractor; if this approach is executed 35, occasionally, the advantages can be immense.

As the money supply will continue increasing for the near future, we’re currently reaching the point at which it makes no way to concentrate on stock market crashes. For, in reality, it is a stock market crash in the event that you bought in at the top, however, it shouldn’t be regarded as a wreck but because the buying opportunity when a person began opening positions throughout the crash.

Monday’s action was confirmation that we will need to change tactics. We talked of

the in the previous two upgrades, and we’re likely to this new approach. Monday’s activity appears to affirm that it’s a waste of time to concentrate on any cycle’s crash facet.

Each stock market crash contributes to the arrival of a brand new bull market. This was the very first big-scale also the time a bull and crisis was killed before its own

time. Along with the wreck was over before it gained any traction. This action informs

intensity won’t last long and the majority of the bears will probably be captured with

Their pants were the situation with all the crash that is a coronavirus.

What do others think about stock market outlook and the future of the work?

Stock Market Outlook: 3 Volatile Weeks, Then Pure Excitement

The stock market is about to evolve – from guesstimate volatility to fundamental trend building. But, first, it needs to close out this quarter’s final trading days and pass through the third quarter’s startup time until it reaches…

… the morning of July 14, when DJIA lead-off JPMorgan Chase JPM -2.7% reports second quarter results, and CEO Jamie Dimon makes good on his 3-month-old promise to reveal the bank’s new strategy and outlook.

Will his comments be positive, negative or a combination? Who knows? However, what we do know is that the information will be valuable and will be based on facts, insight and wisdom. And that means investor excitement because actual business fundamentals and reasoning are reentering the stock market discussion.

Gone will be the dependence on invented “breaking news” and simplistic “analyses” based on linking trader-driven stock market moves to any coincidental tidbits lying around.

What about the elephant in the room: Covid-19?

Oh, it’ll still be with us. However, its overwhelming uncertainties in early April have greatly diminished. Today, most government, institutional and business leaders know what needs to be done, both to function effectively and to contain, if not reduce, the risk of contagion. Read more

JPMorgan’s market guru says stocks can hit new records this summer

Stocks’ price-earnings ratios remain at historic highs, but their value compared to bonds suggests a market booster could be on the horizon, Marko Kolanovic, head of macro quantitative and derivatives research at JPMorgan, said Wednesday.

Central banks’ relief programs prompted an exodus from equities and flooded the bond market with investor cash.

Yet quantitative funds’ trading algorithms are on the verge of triggering a return to the stock market as volatility eases, Kolanovic wrote in a note.

For such firms to reach their median equity exposure, they’d need to add $400 billion to the stock market. A move like that would serve as a shot-in-the-arm for stock valuations and “easily push the broad market to new highs,” the analyst added.

The market is also slated for a mass rotation from growth names to value stocks once investors reprice for weaker-than-expected coronavirus fallout, the bank said.

Visit the Business Insider homepage for more stories.

Stocks sit at historically expensive levels but not in the way that matters most, JPMorgan said Wednesday.

Price-earnings ratios remain elevated, but prices relative to bonds are the signals to watch for future market moves, Marko Kolanovic, head of macro quantitative and derivatives research at the bank, wrote in a note to clients. Stocks are currently “quite cheap” by that measure, and the dislocation is directly tied to a decline in bond yields, he added. Read more

Where the Stock Market Will Be in Six Months

When it comes to the future of the stock market, investors’ predictions are all over the map.

When asked where the S&P 500 Index would end the year, a fifth of respondents to a survey conducted by DataTrek Research said the benchmark will close out 2020 up more than 10% from current levels. That’s roughly the same number who predicted the index will finish down more than 10%.

“Every option from ‘really bad’ (down +10% from here) to ‘really good’ (+10%) got basically the same number of votes,” Nicholas Colas, DataTrek’s co-founder, wrote in an email. “And we’re only talking about the next six months.”

Such dispersion is perhaps understandable after the stock market’s fastest-ever fall into a bear market gave way to the quickest 50-day rally in nine decades. While investors are hopeful for a quick economic recovery from the coronavirus pandemic, the outlook is foggy as cases continue to rise and new risks emerge. Investors also have a wary eye on November’s U.S. presidential election and the potential for volatility around that time.

According to the survey — which attracted 341 responses from June 22 through June 28 — 48% said they expect Joe Biden to win the presidency, compared to 43% who foresee a Donald Trump victory. According to Colas, political expectations weighed heavily on investors’ general market views.

“Respondents who said they believed Trump would win were twice as likely to think U.S. equities would rally by double digits into the year-end,” Colas wrote. Read more

Other Articles of Interest

Bear Market nonsense: Experts want you to think Markets are Going to Crash

US Dollar Finally Hit Bottom?

Uranium Futures price chart

Sophistication in Sentiments: The Stock Market Emotions Chart Explained

The Artful Approach to Winning the Stock Market Game

Harnessing Power: The Dynamic Approach of Small Dogs Of the Dow

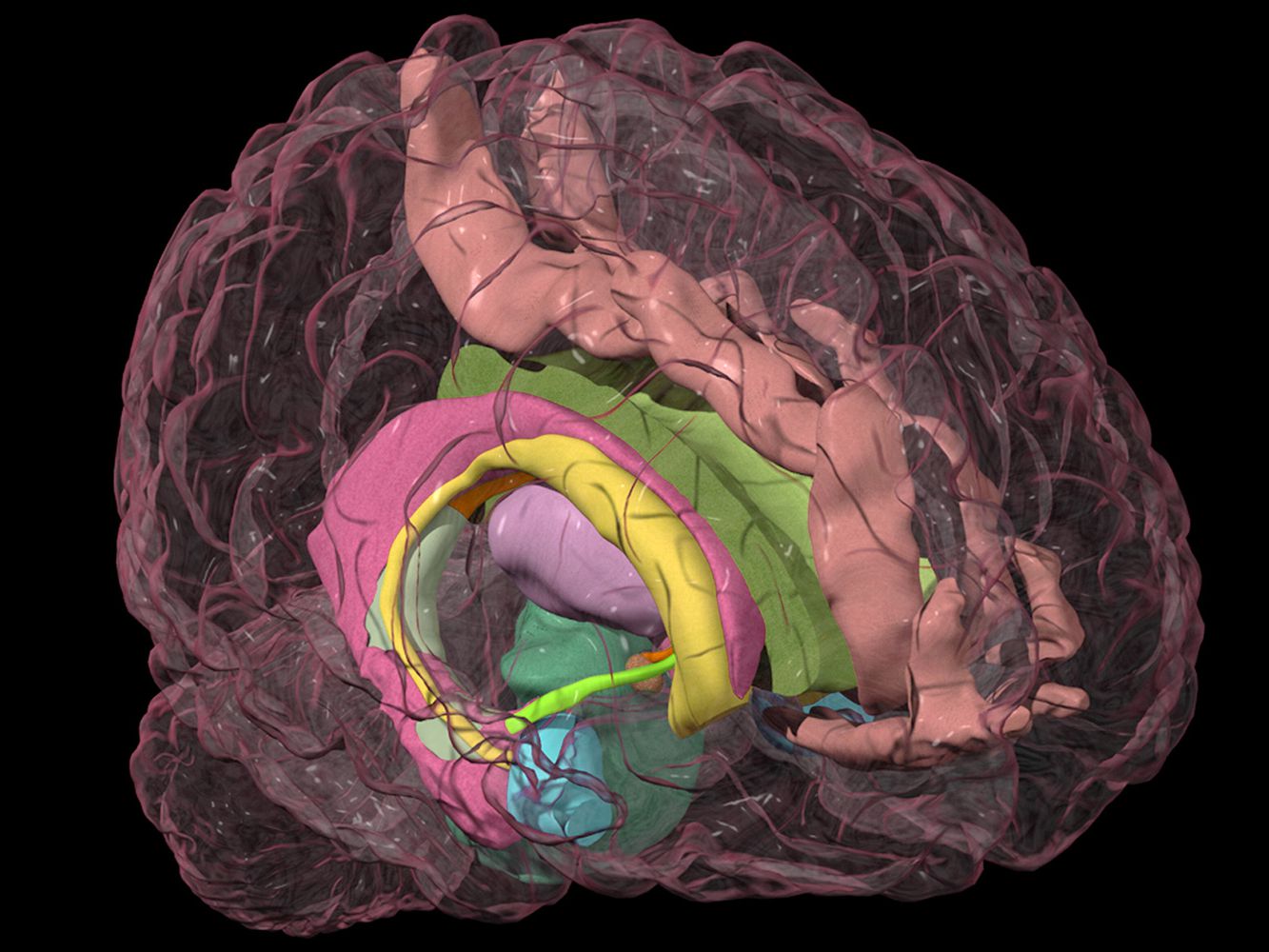

Psychology Unveiled: Exploring the Depths of the Human Mind

Stock Portfolio Tracker

What happens if the stock market crashes?

Achieving Financial Goals with Intelligent Investing Strategies

Stock market performance 2019

Quantitative Easing Definition

Stock Market Update

Stock Market Quotes and Sayings

US Dow Jones Outlook