Introduction: Embarking on Your Journey to Successful Investing in Stocks

Investing in the stock market can be intimidating, especially for those new to finance. The fear of losing money, the complexity of financial jargon, and the constant market fluctuations can deter many potential investors. However, history has shown that anyone can learn to navigate the market and build a thriving portfolio with the right knowledge, strategies, and mindset.

Take the example of Warren Buffett, one of the most successful investors ever. Buffett started investing at 11 and has since amassed a fortune of over $100 billion. His success can be attributed to his disciplined approach, long-term perspective, and ability to identify undervalued companies. Buffett’s journey demonstrates that successful investing in stocks is not about timing the market or chasing the latest trends, but rather about making informed decisions based on fundamental analysis and patience.

Another inspiring example is Geraldine Weiss, the first woman to launch a successful investment newsletter in the 1960s. Despite facing gender discrimination and scepticism from the male-dominated finance industry, Weiss’s investment strategies consistently outperformed the market. Her success proves that successful investing in stocks is not limited by gender, background, or experience but rather driven by knowledge, determination, and a willingness to learn.

In this article, we’ll explore the secrets to successful investing in stocks and provide you with the tools to boost your financial confidence. From understanding the fundamentals of the stock market to developing a sound investment strategy, we’ll guide you through the essential steps to help you make informed decisions and achieve your financial goals. Whether you’re a beginner or an experienced investor looking to refine your skills, this article will equip you with the knowledge and insights to embark on your journey to successful investing in stocks.

Understanding the Fundamentals of Stock Investing

Before diving into the intricacies of stock investing, it’s crucial to grasp the basics. Stocks represent ownership shares in a company. When you purchase a stock, you become a partial company owner, entitled to a portion of its profits and assets. Companies issue stocks to raise capital for growth and expansion, while investors buy stocks to earn returns through capital appreciation and dividends.

As legendary investor Warren Buffett once said, “The best way to learn is to teach, and the best way to teach is to learn.” Educating yourself on the fundamentals of stock investing lays the foundation for making informed decisions and achieving long-term success.

Developing a Sound Investment Strategy

One key to successful stock investing is having a well-defined strategy. This involves setting clear financial goals, determining risk tolerance, and creating a diversified portfolio that aligns with your objectives. When crafting your plan, consider your age, income, and investment timeline.

Renowned investor Peter Lynch emphasizes the importance of investing in what you know. He advises, “Invest in companies you understand, that you believe will grow over the long term, and that you can buy at a reasonable price.” By focusing on industries and companies you are familiar with, you can make more informed investment decisions.

Conducting Thorough Research and Analysis

Successful investors don’t rely on gut instincts or hot tips. Instead, they conduct extensive research and analysis before making investment decisions. This involves studying a company’s financial statements, evaluating its competitive position, and assessing its growth prospects.

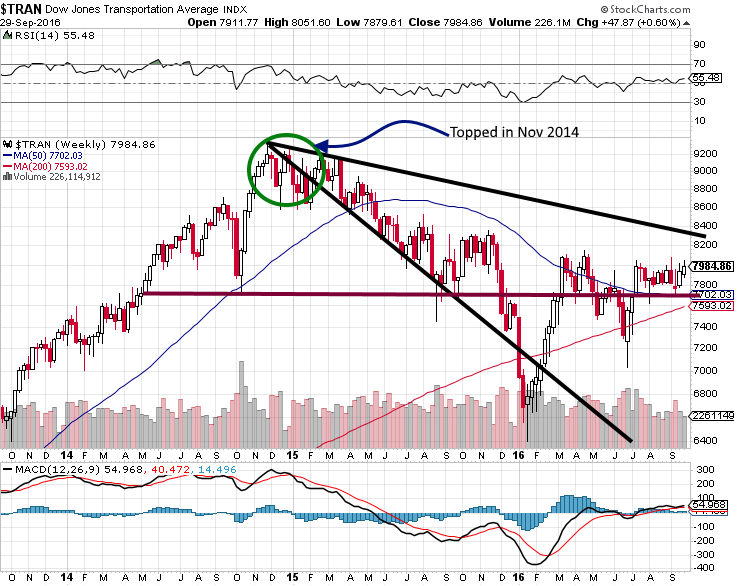

Billionaire investor George Soros stresses the significance of understanding market trends and dynamics. He states, “The key to successful investing is not to predict the future, but to understand the present.” You can make more astute investment choices by staying informed about economic indicators, industry trends, and market sentiment.

Embracing a Long-Term Perspective

One of the most common pitfalls of novice investors is succumbing to short-term market fluctuations and emotional decision-making. Successful investors, on the other hand, adopt a long-term perspective. They understand that the stock market experiences ups and downs, but over time, quality companies tend to appreciate in value.

As renowned investor Benjamin Graham wisely said, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” By focusing on the intrinsic value of companies and holding investments for the long haul, you can weather market volatility and reap the rewards of compounding returns.

Managing Risk and Diversifying Your Portfolio

Risk management is a critical aspect of successful investing in stocks. No investment is entirely risk-free, but by diversifying your portfolio across different sectors, industries, and even geographical regions, you can mitigate the impact of any single investment’s performance on your overall returns.

Legendary investor Ray Dalio emphasizes the importance of diversification, stating, “Diversification is the most important thing you need to do to invest well.” By spreading your investments across various assets, you can reduce volatility and enhance the stability of your portfolio.

Staying Disciplined and Avoiding Emotional Pitfalls

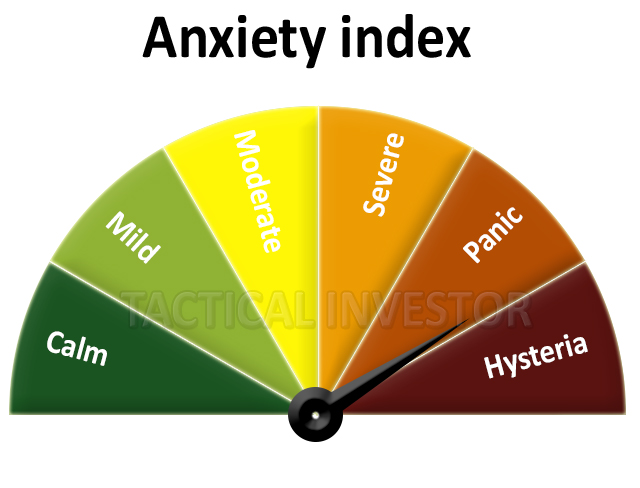

Emotions can be the downfall of even the most seasoned investors. Fear, greed, and panic can lead to impulsive decisions that derail your investment strategy. Successful investors learn to control their emotions and stick to their plans, even in market turbulence.

As renowned investor John Templeton once said, “The four most dangerous words in investing are ‘This time it’s different.'” By maintaining discipline, avoiding herd mentality, and focusing on your long-term goals, you can confidently navigate the emotional rollercoaster of the stock market.

Continuously Learning and Adapting

The investing world constantly evolves, with new companies, technologies, and economic trends emerging. Successful investors recognize the importance of continuous learning and adapting to changing market conditions. They stay curious, seek out knowledge, and are open to refining their strategies when necessary.

As billionaire investor Mark Cuban advises, “Always be learning. The day you stop learning is the day you start dying.” By staying informed, attending educational seminars, reading financial publications, and seeking guidance from experienced professionals, you can enhance your investing skills and make more informed decisions.

Conclusion: Mastering the Art of Successful Investing in Stocks

Successful stock investing requires knowledge, strategy, discipline, and a long-term perspective. By understanding the fundamentals, conducting thorough research, managing risk, and staying emotionally grounded, you can confidently navigate the stock market and work towards achieving your financial goals.

Remember, investing is a journey, not a destination. Embrace the process, learn from your experiences, and stay committed to your strategy. With dedication and a willingness to learn, you can master the secrets of successful stock investing and build a prosperous financial future.

https://www.youtube.com/watch?v=xvAOaKJ8Meo

Mental Marvels: Discovering Hidden Gems

Which of the following risks would benefit most from portfolio diversification?

The Elegant Definition of Portfolio Diversification: Mastering Risk Management

Exploring the Artistry of Stock Market Trends 2022: A Journey Through Finance

Igniting Your Investing Passion: The Inspiring Lessons of peter lynch books

Finesse Your Finances with Recommended Portfolio Diversification Strategies

Mastering the Finesse of Example Investment Portfolio Diversification Techniques