An investment pyramid, or risk pyramid, functions as a tactical roadmap for portfolio distribution, considering the varying risk levels tied to different investments. With this method, the risk associated with a particular investment is gauged by the inconsistency in its possible return or the likelihood that the investment’s value could take a considerable dip.

The base of the investment pyramid is home to low-risk investments, forming the most extensive segment. Investments in this category are usually marked by their steadiness and insignificant value fluctuations over time. These assets are the go-to for investors looking for a solid base for their portfolio, with the goal of capital protection while reaping moderate profits.

As we ascend the pyramid, the middle segment is reserved for growth investments. These investments pose a higher risk than low-risk assets but also come with the possibility of higher returns. Growth investments might include the stocks of well-established companies with encouraging growth potential or mutual funds aiming at capital appreciation over an extended period. Despite the possibility of more substantial oscillations, these assets are chosen by investors with a moderate tolerance for risk, aiming for a balance between potential profits and a tolerable risk level.

The top of the pyramid is designated for speculative investments, which constitute the smallest portfolio allocation. Speculative investments carry considerable risk due to their inherent unpredictability and potential for significant price fluctuations. This category can include high-risk stocks of startup companies, unstable commodities, or other assets susceptible to swift changes in value. Investors who dedicate a part of their portfolio to speculative investments are generally prepared to accept higher risk levels in the quest for potentially significant returns.

Unlocking Prosperity with the Investment Pyramid: From Structure to Strategic Mastery

The strategic blueprint, known as the investment pyramid, highlights the significance of diversification, promoting a comprehensive portfolio that harmonizes risk with potential returns across various asset types. By judiciously partitioning investments across the pyramid’s three tiers, investors aim to fine-tune their risk-reward balance while aligning their investment decisions with their financial objectives and risk comfort levels.

While the design of the investment pyramid often garners considerable focus, it’s essential to turn the spotlight towards developing a solid system for pinpointing powerful stocks within resilient sectors. The core concept lies in the pyramid’s configuration and in refining a technique that can detect rising stars within robust sectors. The gateway to prosperity opens by investing in stocks on the brink of a breakout or deeply rooted in a strong uptrend phase, resulting in a success rate surpassing 80%. However, concentrating solely on the frequently arbitrary ratios promoted by the majority of investment pyramids without developing a thoroughly planned strategy could be detrimental in the long-term investment journey.

Strategic Perspectives: The Layers of Our Investment Pyramid Our investment pyramid embraces simplicity, directing investors towards wise allocation of capital. A substantial segment is reserved for sturdy stocks/ETFs, with the focus on holding these positions until the trend concludes. At Tactical Investor, we utilize the Trend Indicator to effectively identify emerging trends.

Benefits of the Investment Pyramid Strategy

A portion of your funds, between 20% and 30%, should be assigned to swing trades—a strategy unlike day trading. Contrary to the often fruitless path of day trading, which leads many individuals to end up with less than they started, swing trading within our pyramid involves maintaining positions for 3 to 6 months, maximizing potential profits without assuming unnecessary risk.

Advancing within the pyramid, we discover options investing, which may astonish us with its capacity to deliver remarkable returns or offer a consistent income flow. The golden rule is to limit option investing to 20% of your portfolio, a precaution against excessive exposure. This portion is divided into 6 to 10 lots, with evenly distributed investment amounts assigned to each play.

Embracing Tactical Diversification: The Route to Empowered Investment

This concept reverberates in stock investment, where total capital balances are evenly distributed. Imagine, for instance, splitting $100,000 into ten portions of $10,000. Each portion is then broken down into three lots, facilitating phased investments. This technique provides an opportunity to purchase the same stock or option at a reduced price during possible pullbacks, enhancing potential gains while reducing risk.

In its essence, our investment pyramid maps a journey that begins with the foundational solidity of stocks and ETFs, navigates through strategic swing trades, and culminates in the tactical domain of options investing. By adhering to this method, investors tap into the power of deliberate diversification, ensuring their portfolio flourishes on a mix of stability, growth, and tactical potential.

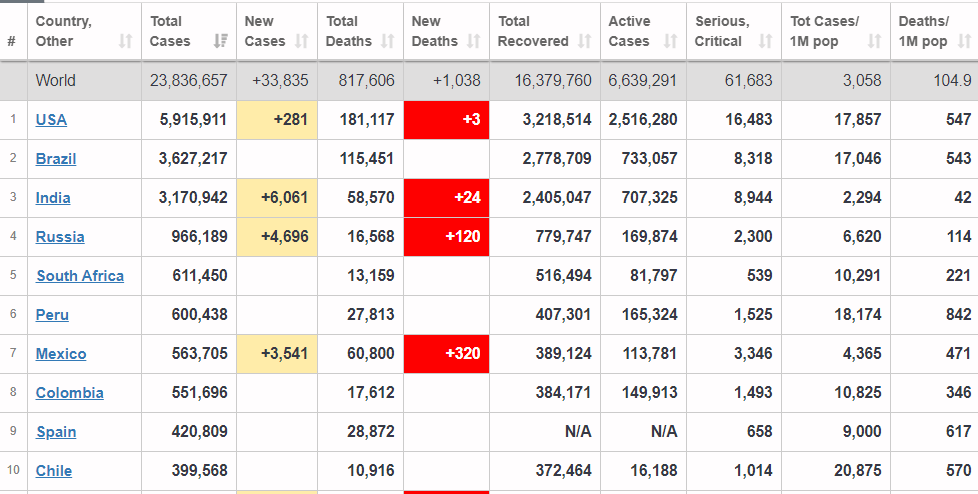

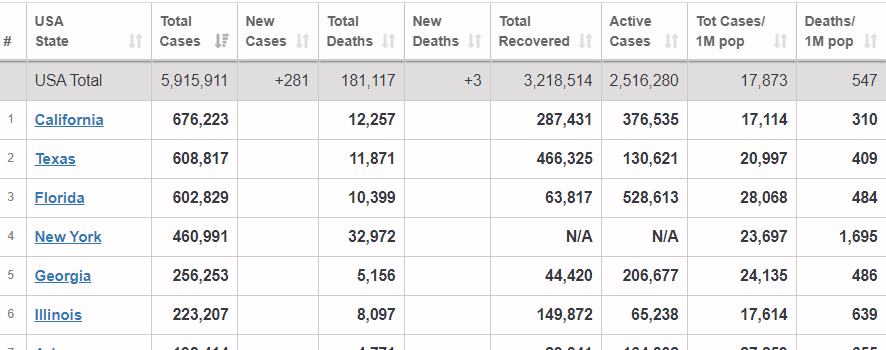

Steering Through Market Trends: A Focus Beyond Investment Pyramids So, what direction is the market taking? Let’s revisit our viewpoint during the market crash in March 2020. In this novel paradigm, amidst the dominating disorder, it’s vital to realize that while the investment pyramid principle retains importance, it’s not the primary concern. The focus lies in aligning oneself on the advantageous side before considering the application of investment pyramid or risk pyramid strategies.

Long before the outbreak of the pandemic, we remarked on the resolute trajectory of central bankers, especially the Fed, towards steering interest rates towards near-zero levels. Imagine the reaction if the Fed had implemented a 150-basis point rate cut just two weeks ago—such a move would have elicited a range of responses. It’s remarkable that when the Fed lowered rates before the onslaught of the coronavirus crisis, critics were quick to brand it as imprudent.

However, fast forward to a 150-basis point rate cut in the aftermath of the crisis, and the sentiment changes to calling for more action. Note the complexity of this strategy: to carry out actions that the majority disapproves, a distraction must first be set up, seizing their attention. Then, a solution that’s three times more potent than the initial problem is introduced. In their pursuit of security, people are likely to accept whichever route is proposed, regardless of its actual ramifications.

Other Articles of Interest

US Stock Market Trends: A Sophisticated Guide to Navigating the Financial Landscape

Illuminate Your Path to Success: Brilliant Benjamin Graham Quotes

Polishing Your Financial Acumen: What is Return on Investment Formula?

What Investing Is: A Journey of Finesse and Financial Acumen

Unlocking the Brilliance of Portfolio Diversification Theory for Optimal Returns

Unsystematic risk can be effectively eliminated by portfolio diversification